Investment

" An Investment In Knowledge Pays The Best Interest "

Benjamin Franklin

Why Invest in Capital Market ?

The capital market is a financial market where long-term debt or equity-backed securities are bought and sold. It’s a marketplace for individuals, institutions, and companies to raise capital and invest for the long term. Capital markets play a crucial role in the overall economy by facilitating the transfer of funds from savers and investors to businesses and projects that need financing.

Now a day’s world is watching Indian capital market, so investment is very important for our growth. Because next 20 years are growth years of Indian economy. Soo many MNC’s are willing to setup their businesses in India and as of now India is 5th fastest growing economy in the world. In future India became a 3rd largest economy in the world, so this is the right time to invest in capital market.

Here are the main components and functions of the capital market:

Primary Market:

The primary market is where new securities (stocks, bonds, etc.) are issued for the first time. This is where companies and governments raise capital by selling newly created securities to investors.

Initial Public Offerings (IPOs) and bond issuances are common activities in the primary market.

Secondary Market:

The secondary market, also known as the stock market, is where existing securities are bought and sold between investors without involvement from the issuing company.

Investors can buy and sell previously issued stocks, bonds, derivatives, and other financial instruments in the secondary market.

Equity Market:

The equity market is a subset of the capital market where shares of publicly listed companies are bought and sold.

It enables companies to raise funds by issuing shares to the public and allows investors to become partial owners of the company.

Debt Market:

The debt market, also known as the bond market, is a segment of the capital market where debt securities (bonds) are bought and sold.

Investors lend money to entities (e.g., governments, corporations) by purchasing bonds and receive regular interest payments and the return of the principal amount at maturity.

Derivatives Market:

The derivatives market involves financial instruments whose value is derived from the value of an underlying asset, index, or rate.

Derivatives include options, futures, swaps, and other financial contracts used for hedging, speculation, or investment purposes.

Functions of Capital Markets:

Facilitating Capital Formation: The capital market provides a platform for companies and governments to raise long-term capital for various projects and activities.

Price Discovery: Through the buying and selling of securities, the market determines the prices of assets based on supply and demand dynamics.

Risk Management: Investors use derivatives and other instruments to hedge against risks associated with fluctuations in interest rates, commodity prices, and more.

Liquidity Provision: The secondary market provides liquidity, allowing investors to convert their investments into cash by selling their securities.

Investor Protection: Regulatory bodies oversee the functioning of the capital market to ensure fairness, transparency, and investor protection.

The capital market is a vital part of the financial system, contributing to economic growth and development by channeling funds from investors to entities that need capital for growth and expansion.

If you wish to Invest in any listed options, List of documents to be keep in hand for upload & details require for KYC

PAN Card

Aadhaar Card with mobile number link is mandatory

Bank Account Details

E- mail ID & Mobile Number

Nomination Details is Mandatory

Investment Options :

What are the types of Investment ?

Mutual Fund (Equity/Debt Fund)

Capital Market (Equity / Commodity)

Fixed Deposit (Bank / Post / Corporate / NBFC)

Bond (Govt. Bond / Municipal Bond / Corporate Bond / Tax Benefit Bond)

Insurance (Life & General Insurance)

Mutual Fund

About Mutual Funds as a Product :

Over the past two decades, India has risen to become the fifth-largest economy in the world, a transformation driven by sound government policies, strong demographics, and robust technological advancements. With that, the Mutual Fund industry is also accelerating at a rapid pace.

The transition from traditional investment products to the stock market is now evident through mutual funds in India. Mutual Funds have played a pivotal role in boosting the confidence and faith of investors in the Indian stock market.

Mutual Funds offer investors a huge investment opportunity to capitalise on the stock market and potentially achieve superior returns compared to fixed-income instruments.

Being the perfect blend of risk and returns, Mutual funds are slowly becoming the preferred investment avenue for investors.

As you read, you will realise that equity mutual funds have emerged as an investment avenue that exponentially builds investors’ wealth, beating the returns of other asset classes, such as gold and fixed deposits.

WHAT IS MUTUAL FUNDS?

A mutual fund is a collective investment vehicle that collects & pools money from a number of investors and invests the same in equities, bonds, government securities, money market instruments.

The money collected in mutual fund scheme is invested by professional fund managers in stocks and bonds etc. in line with a scheme’s investment objective. The income / gains generated from this collective investment scheme are distributed proportionately amongst the investors, after deducting applicable expenses and levies, by calculating a scheme’s “Net Asset Value” or NAV. In return, mutual fund charges a small fee.

In short, mutual fund is a collective pool of money contributed by several investors and managed by a professional Fund Manager.

Mutual Funds in India are established in the form of a Trust under Indian Trust Act, 1882, in accordance with SEBI (Mutual Funds) Regulations, 1996.

The fees and expenses charged by the mutual funds to manage a scheme are regulated and are subject to the limits specified by SEBI.

History of Mutual Funds :

The history of mutual funds dates back to the 19th century when the first investment trust was formed in London in 1860s. However, the popularity of mutual funds remined scant during that period.

It was 6 decades later when the United States came up with the first mutual fund – The Massachusetts Investors Trust in 1924. The first index fund was established in 1976.

Despite the growing popularity among investors in the 1950s and 1960, mutual funds gained momentum in the 1980s. The 1980s and 1990s were times of unprecedented bull markets.

History of Mutual Funds in India :-

Unit Trust of India (UTI) was the first mutual fund set up in India in the year 1963.

In the early 1990s, the government permitted public sector banks and institutions to set up Mutual Funds.

In the year 1992, the Securities and Exchange Board of India (SEBI) Act was established. The objectives of SEBI are

Formulating and regulating policies of Mutual Funds

Protecting investors’ interests

To promote the development of securities market

In 1993, SEBI notified the rules for Mutual Funds

After 1993, private sector companies began offering Mutual Funds.

In 1996, the regulations were completely revised and updated

Thereafter, SEBI issued guidelines for Mutual Funds from time to time to protect the interests of investors.

Mutual Fund Industry’s Major Milestones :

1964 – ‘Unit Scheme 64’ the first Indian mutual fund scheme was launched by the Unit Trust of India.

1987 – The Government allowed Non-UTI public sector companies to enter the mutual fund industry.

1993 – The Government allowed private sector companies to enter the mutual fund industry.

2014 – In May, the mutual fund AUM (Asset Under Management) surpassed ₹10 Lakh crore for the first time.

2017 – In August, the mutual fund AUM (Asset Under Management) crossed ₹ 20 Lakh crore.

2023 – In September, the mutual fund folios increased to 15.71 crore and AUM (Asset Under Management) stood at ₹ 46.58 Lakh crore.

Mutual Fund Current Scenario :

Over the past two decades, the mutual fund industry in India has witnessed as unprecedented surge, soaring to new heights of prosperity. The Assets Under Management (AUM) of the industry was ₹ 1.07 lakh crore* in September 2003, and has now sky-rocketed to an astounding ₹ 46.58 lakh crore * in September 2023. This phenomenal growth can be attributed to a multitude of factors, including heightened awareness about mutual funds and an upsurge in disposable income amongst the masses.

Mutual fund distributors remain at the heart of this industry and have been instrumental in spearheading the growth and success of the industry.

Despite the remarkable surge in the mutual fund industry, the penetration of mutual funds in the Indian economy still remains low, with slightly over 3.5 crore of the nation’s vast population of 140 crore investing in them.

Furthermore, India’s AUM to GDP ratio is a mere 17%, which is in contrast to the global average of 75%, as per AMFI and World Bank reports of 2021. Comparing it to the US, France, and the UK, at 140%, 80% and 67% (AMFI & World Bank, 2021), respectively, shows that India has yet to walk a long path before the industry can achieve the pinnacle of success, and this is just the beginning.

Features of Mutual Funds :-

Schemes managed by professional fund managers

Mutual funds offer a variety of schemes that you can choose as per your needs and convenience

Mutual funds diversify risks by investing in multiple companies across a wide range of sectors

Mutual funds have the potential to provide high returns in the medium to long term

Investing in equity in mutual funds is relatively less expensive than investing directly in the stock markets

Some mutual fund schemes provide liquidity. This means that you can withdraw money whenever you want.

Mutual funds provide transparency in terms of disclosing the investment strategy, ratio of asset class to investment, value of your investment and periodic statements.

Mutual funds are regulated by SEBI

Some mutual fund schemes (like ELSS) provide tax benefits

Mutual fund schemes offer SIP (Systematic Investment Plan) option to investors to invest small amounts on regular basis

Income Tax Benefits :-

To get a good understanding of income tax benefits in Mutual Funds, you need to know the following things.

Section 80C Benefits

Dividends Payout Tax

Capital Gains Tax (CGT)

TDS (Tax Deducted at Source)

Description about each item is given below.

Section 80C Benefits

With effect from 01 April 2020, the benefit of Section 80C will be available only on the Old Tax Regime. They are not available under the New Tax Regime.

ELSS (Equity Linked Saving Scheme) provides tax benefits under Section 80C of the Income Tax Act.

Under the ELSS scheme, investments of up to Rs 1.5 lakh in a financial year will be eligible for tax deduction under Section 80C.

For tax on maturity or withdrawal amount, please see the “Capital Gains Tax” section below.

Dividends Payout Tax

Earlier, dividends received from a mutual fund company were completely tax free for an investor. But, for a mutual fund company, the dividend declared was taxed and was known as Dividend Distribution Tax (DDT).

The DDT rate was 10% for equity funds and 28.84% for debt funds.

The mutual fund company was responsible for paying DDT to the Government of India. NAV of the fund reduced to the extent of DDT deduction.

With effect from 01 April 2020, DDT will be removed. This means the mutual fund company will not deduct DDT while paying dividends.

But, dividends will be taxable to the investor as per their income tax slab.

Therefore, if you receive dividends from a mutual fund company, they will be added to your income and then taxed as per your income tax slab.

Here’s what you need to know before you opt for dividend payout in mutual funds.

Capital Gains Tax (CGT)

The profit you get when you sell mutual fund units is known as “capital gains” and the tax applicable on these profits is known as “capital gains tax”.

Capital gains tax can be divided

Short Term Capital Gains Tax

Long Term Capital Gains Tax

Capital gains tax depends on

1. Type of mutual fund (equity or non-equity)

2. Investment period

Details regarding capital gains tax for each fund type are given below.

A) Equity Funds – Long Term Capital Gains Tax

If you invest in equity funds for more than 1 year and make profits, it is known as “Long Term Capital Gain”.

From April 01, 2018, there will be no tax on profits up to Rs 1 lakh. After that, any profit is taxed at 10% without indexation.

Before April 01, 2018, the tax rate was 0% and hence you did not have to pay any tax on profits.

B) Equity Funds – Short Term Capital Gains Tax

If you invest in equity funds for less than 1 year and make profits, it is known as “Short Term Capital Gain”.

The tax rate is 15% and hence you will have to pay 15% tax on your profits

C) Non-Equity Funds – Long Term Capital Gains Tax

If you invest in non-equity funds for more than 3 years and make profits, it is known as “Long Term Capital Gain”.

The tax rate is 20% with indexation and hence you have to pay 20% tax on your profits.

D) Non-Equity Funds – Short Term Capital Gains Tax

If you invest in non-equity funds for less than 3 years and make profits, it is known as “Short Term Capital Gain”.

Profits will be added to your income under “Income from capital gains” and you will have to pay tax as per your income tax slab.

Note:- Indexation is the process of increasing purchase prices in line with inflation.

TDS (Tax Deducted at Source)

Earlier, there was no TDS (tax deducted at source) concept in mutual fund investments.

But, effective from April 01, 2020, TDS will be levied on dividends paid to investors.

If the dividend to be paid is more than Rs 5,000/- then the mutual fund company will deduct 10% of the dividend amount as TDS.

If excess TDS has been deducted, you can claim it back when you file your income tax return.

Who can invest in Mutual Funds ?

Mutual Funds schemes are open to a wide range of investors including

Resident Individuals

HUF (Hindu Undivided Family)

NRI (Non Resident Indian)

PIO (People of Indian Origin)

Companies

Trusts

Co-Operative Societies , etc.

What is NAV ?

NAV means “Net Asset Value”.

NAV is the current market value of a unit of the mutual fund scheme.

NAV is calculated on a daily basis for open ended schemes and on a weekly basis for closed ended schemes

NAV is calculated after deducting all expenses and fees incurred by the fund

The NAV value depends on the performance of the mutual fund scheme

Nomination Facility

Nomination facility is available in all schemes of mutual funds

Nomination can be made only by individuals singly or jointly

Non-individuals like trust, society, partnership firm, body corporate etc. cannot make nomination

You can nominate up to 3 people as nominees

In case of multiple nominees, you have to specify the percentage of share (%) for each nominee

The total percentage of shares must be 100%

You can nominate a minor as a nominee and in that case you will be required to provide the name, address and signature of the parent or guardian.

Nomination made by an individual will be applicable to all scheme of the folio

Nomination is not permitted for a folio which is in the name of a minor

Type of Fund

Growth Funds : In a growth plan, the fund does not payout anything to the investors by way of regular payouts or dividends. All the profits of the fund are reinvested in the fund and so your wealth compounds automatically.

Debt Funds : A debt fund is a mutual fund scheme that invests in fixed income instruments, such as Corporate and Government Bonds, corporate debt securities, and money market instruments etc. that offer capital appreciation. Debt funds are also referred to as Income Funds or Bond Funds.

Balance Advantage Fund : Balanced advantage funds are mutual fund schemes that invest in both equity and debt securities. Unlike regular hybrid funds, which keep allocation between equity and debt within certain prescribed limits, BAFs have no such limits and move their allocations more dynamically.

Hybrid Equity Fund : Hybrid funds, as the name suggests, are funds that invest in a blend of more than one asset class. These could be debt/fixed deposit type of securities, equity, commodities (Gold). Mostly Hybrid funds invest in debt and equity in various proportions. Balanced funds are just one type of Hybrid funds.

Income Funds : An income fund is mutual fund or a ULIP (unit-linked investment plan) or any other type of investment that aims at generating an income stream for investors by investing in fixed income securities like government securities or gsecs/gilts, bonds, debentures, fixed deposits and the like.

Liquid Funds : A Liquid Mutual Fund is a debt fund which invests in fixed-income instruments like commercial paper, government securities, treasury bills, etc. with a maturity of up to 91 days. The net asset value or NAV of a liquid fund is calculated for 365 days.

Tax-Saving Funds (ELSS) : An ELSS is an Equity Linked Savings Scheme, that allows an individual or HUF a deduction from total income of up to Rs. 1.5 lacs under Sec 80C of Income Tax Act 1961. These schemes have a lock-in period of three years from date of units allotment. After the lock-in period is over, the units are free to be redeemed or switched. ELSS offer both growth and dividend options. Investors can also invest through Systematic Investment Plans (SIP), and investments up to ₹ 1.5 lakhs, made in a financial year are eligible for tax deduction

Aggressive Growth Funds : An aggressive growth fund is a mutual fund that seeks capital gains by investing in the shares of growth company stocks. Investments held in these funds are companies that demonstrate high growth potential, but also carry greater risk.

Capital Protection Funds : Capital protection-oriented fund is a class of closed-end hybrid fund. Its primary objective is to safeguard investors’ capital in the event of market downturns while simultaneously providing them scope for capital appreciation by participating in upturns of the equity market.

Fixed Maturity Funds : Fixed Maturity Plan (FMP) is a fixed tenure mutual fund scheme, that invests its corpus in debt instruments maturing in line with the tenure of the scheme. The tenure of an FMP can vary between a few months to a few years. Ideal for investors with a tenure in mind. Minimal Interest Rate Risk. Better post Tax Returns.

Retirement / Pension Funds. : Retirement funds, also known as pension funds, are investment options that allow an individual to save a certain portion of their income for their retirement. These funds offer a regular source of finance after one retires; a retiree receives annuity on their investment until their demise.

HOW A MUTUAL FUND WORKS?

One should avoid the temptation to review the fund’s performance each time the market falls or jumps up significantly. For an actively-managed equity scheme, one must have patience and allow reasonable time – between 18 and 24 months – for the fund to generate returns in the portfolio.

When you invest in a mutual fund, you are pooling your money with many other investors. Mutual fund issues “Units” against the amount invested at the prevailing NAV. Returns from a mutual fund may include income distributions to investors out of dividends, interest, capital gains or other income earned by the mutual fund. You can also have capital gains (or losses) if you sell the mutual fund units for more (or less) than the amount you invested.

Mutual funds are ideal for investors who –

lack the knowledge or skill / experience of investing in stock markets directly.

want to grow their wealth, but do not have the inclination or time to research the stock market.

wish to invest only small amounts.

For More Details Click Here

How to invest in Mutual Fund ?

SIP –

SWP –

STP –

ELSS –

Lumpsum –

1. SIP – (Systematic Investment Plan)

A Systematic Investment Plan (SIP) is a mode of investment for mutual funds in which investors make regular, automated contributions periodically. With SIPs, you can plan your investments to achieve your financial goals over the long term. You can do this by determining the target amount and the amount you’d like to invest at periodic intervals in a mutual fund scheme you’ve chosen.

SIP is an investment route offered by Mutual Funds wherein one can invest a fixed amount in a Mutual Fund Scheme at regular intervals– say once a month or once a quarter, instead of making a lump-sum investment. The installment amount could be as little as Rs 500/- a month and is similar to a recurring deposit. It’s convenient as you can give your bank standing instructions to debit the amount every month.

SIP has been gaining popularity among Indian MF investors, as it helps in investing in a disciplined manner without worrying about market volatility and timing the market. Systematic Investment Plans offered by Mutual Funds are easily the best way to enter the world of investments for the long term. It is very important to invest for the long-term, which means that you should start investing early, in order to maximize the end returns. So your mantra should be – Start Early, Invest Regularly to get the best out of your investments.

SIP has empowered countless individuals to take control of their financial future, invest small amounts towards their needs and watch them bloom into an enormous fund.

2. SWP – (Systematic Withdrawal Plan)

A systematic withdrawal plan (SWP) helps you withdraw money from your mutual fund in a regular and planned manner. You can choose how much money you want to withdraw and how often you want to withdraw it, i.e., the frequency, which is often monthly. Then on a designated date, units amounting to that fixed amount would be redeemed. For example, an investor could invest Rs. 10 lacs and request that Rs. 10,000 be paid on the 1st of every month. Then, units worth Rs. 10,000 would be redeemed on the 1st of every month.

It is important to note that the tax treatment for both, dividend and SWPs, vary, and investors need to plan accordingly.

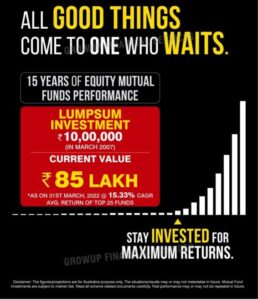

3. Lump sum

A lump sum amount is defined as a single complete sum of money. A lump sum investment is of the entire amount at one go. For example, if an investor is willing to invest the entire amount available with him in a mutual fund, it will refer to as lump sum mutual fund investment.

With lumpsum investment in a mutual fund, you invest your funds earmarked for investments in any mutual fund scheme of your choice. For instance, if you have Rs. 1 lakh to invest, you invest the entire lumpsum amount in a mutual fund in one go.

The mantra for building wealth is quite simple. An investor just needs to be disciplined, invest in the right asset class, and remain invested for a longer period of time to reap the benefit of the power of compounding.

4. ELSS – (Equity-Linked Savings Scheme)

An Equity-linked savings scheme or ELSS or is a mutual fund class that offers tax rebate under Section 80C of the Income Tax Act, 1961. You can claim tax deductions of up to Rs 1.5 lakh a year by investing in ELSS. ELSS mutual funds have the potential to offer the highest returns among all Section 80C investments.

Thus if an investor was to invest Rs.1,50,000 in an ELSS, then this amount would be deducted from the total taxable income, thus reducing her tax burden.

These schemes have a lock-in period of three years from date of units allotment. After the lock-in period is over, the units are free to be redeemed or switched. ELSS offer both growth and dividend options. Investors can also invest through Systematic Investment Plans (SIP), and investments up to ₹ 1.5 lakhs, made in a financial year are eligible for tax deduction

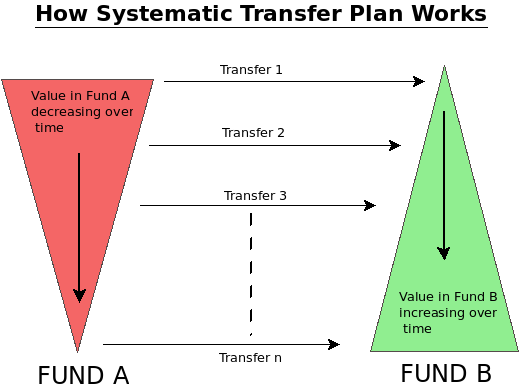

5. STP – (Systematic Transfer Plan)

A Systematic Transfer Plan (STP) allows you to transfer a fixed number of units or amount from your investment in one Mutual Fund scheme to another scheme managed by the same fund house on a prespecified day every month.

You can start a STP by investing a lumpsum amount in a mutual fund scheme and giving instruction to the fund house to transfer a fixed no. of units or amount from this investment to the destination scheme. As a result, your account balance in the source scheme i.e. the scheme in which you had made the lumpsum investment gradually decreases every month while your investment in the destination scheme increases gradually every month. The STP automatically stops when all the money from the source scheme has been transferred to the destination scheme over a period of time.

STP is a risk mitigation strategy where you move your investments from an equity fund to a debt fund or vice-versa depending on the market outlook you hold. STP is usually done by investing a lump sum amount in a debt scheme and transferring the money over time to an equity scheme or vice-versa.

STP is best advisable when you have a large sum of money to invest but are not sure how the market will move once you’ve invested your money. So, you gradually move or switch your money from one scheme to another in a phased manner over time.

Source -mutualfundssahihai

Corporate Fixed Deposit

Corporate Fixed Deposits are one of the fund-raising instruments for companies. Through these companies raise money from the public and provide interest at a fixed rate for different periods.

Like banks, several companies and NBFCs are also allowed to collect deposits for a fixed tenure at a prescribed interest rate. Such deposits are called corporate Fixed Deposits. Similar to banks they come with the assurance of guaranteed returns and flexibility of choosing the tenure. Plus, corporate FDs provide a higher interest rate than bank FDs.

Here are the main features and details about Corporate Fixed Deposit:

Issuers: Corporations and NBFCs issue corporate fixed deposits to raise money for their operational and expansion purposes. These issuers are not banks but are allowed to raise deposits from the public.

Interest Rates: Corporate fixed deposits offer a fixed interest rate which is generally higher than the interest rates offered by traditional bank fixed deposits. Interest rates may vary between different issuers and may be affected by factors such as the issuer’s credit rating and prevailing market conditions.

Tenure/Maturity Period: Corporate term deposits have a predetermined maturity period, which can range from a few months to several years. Investors choose the tenure while depositing.

Interest Payment Frequency: Interest payment frequency may vary depending on the terms of the issuer. Some corporate fixed deposits offer interest payments monthly, quarterly, half-yearly or annually.

Risk: Corporate fixed deposits carry higher risk than bank fixed deposits because they are not insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), which insures bank deposits up to a certain limit.

Credit Rating: It is important to assess the credit rating of the issuer by checking its credit rating, which is determined by credit rating agencies. A higher credit rating suggests less default risk.

Liquidity: Corporate term deposits are not as liquid as bank term deposits. While premature withdrawals are usually allowed, there may be penalties or lower interest rates involved.

Taxation: Interest earned on corporate term deposits is generally taxable. Investors need to consider the tax implication of their earnings when investing in these deposits.

Documentation: To invest in corporate fixed deposits, investors need to complete the necessary documentation, which may include submission of fixed deposit application form and Know Your Customer (KYC) documents.

Nomination: Investors can nominate a beneficiary to receive the deposit amount in the event of the investor’s death.

For More Details Refer Our Blog Click Here

Bond

A bond is a debt security. Bond is a fixed-income tool that represents a loan from an investor to a debtor. It is a contract between the investor and the debtor, where the debtor uses the money to fund its operation and the investors receive interest on the investment.

Bonds are high-security debt tools that fall under the secure income asset class. It enables an entity to raise funds to fulfill the capital obligation for funding various plans. It is a debt that debtor’s avail from individuals for a specified period.

These are issued by the Government, Corporates, Municipalities, states, and other entities to fund their plans. These bonds have a maturity date and when once that is attained, the issuer needs to pay back the amount along with a part of the profit to the investor.

Here are the key features of the bond:

Issuer: The entity that issues the bond, which may be a government (government bond or treasury bond), corporation (corporate bond), municipality (municipal bond), or other organization.

Face Value (Par Value): The initial value of the bond, which is usually the amount the issuer promises to repay the bondholder at maturity.

Coupon Rate: The fixed or variable interest rate that the bond issuer agrees to pay to bondholders over the life of the bond. It is expressed as a percentage of the face value of the bond.

Coupon Payments: Bondholders receive periodic interest payments based on the bond’s coupon rate and face value, usually semi-annually or annually. These payments are often referred to as coupon payments.

Maturity Date: The date on which the bond issuer agrees to repay the face value of the bond to the bondholder. Bonds may have short-term (less than one year), intermediate-term (one to ten years), or long-term (more than ten years) maturities.

Yield: Yield represents the effective interest rate an investor earns on a bond, which takes into account the bond’s current market price, coupon payments, and time to maturity. It reflects the overall return of the bond.

Market Value: Bonds can be bought and sold in the secondary market, and their prices can fluctuate depending on changes in interest rates, the creditworthiness of the issuer, and market conditions. The market price of a bond may be either more (trading at a premium) or less (trading at a discount) than its face value.

Credit Rating: Bonds are often assigned a credit rating by credit rating agencies. These ratings reflect the issuer’s creditworthiness and likelihood of timely interest and principal payments. Bonds with higher ratings are considered less risky.

Bonds serve a variety of purposes for both issuers and investors:

Issuer: Bonds are a way for governments and companies to raise capital for projects, operations, or to refinance debt. They offer the option of raising funds through equity (for example, issuing stock).

Investors: Bonds are attractive to investors seeking income and relative safety compared to stocks. They are often included in diversified investment portfolios to balance risk and provide stable income.

Bonds are considered fixed-income securities because they provide a predictable flow of income through regular interest payments. Investors buy bonds to receive interest income and potentially benefit from price appreciation if they sell the bond before maturity for a higher price than they paid for it.

The price of a bond and its yield are inversely related; When bond prices rise, yields fall, and vice versa. Bond investing involves evaluating factors such as credit risk, interest rate risk, and market conditions to make investment decisions. Bonds can be an essential part of a diversified investment portfolio and are frequently used for income generation and capital preservation.

54 EC Bond for Capital Gain Benefit in Income Tax

There are also investment options called 54EC bonds called Capital Gains Tax Exemption Bonds, which allow exemption under 54EC of the Income Tax Act, 1961. These are given to investors who had earned LTCG (Long Term Capital Gain) from the sale of the building or land or both and would like to invest in it. Take advantage of tax exemption on these benefits. It involves two bonds, one each of the National Highways Authority of India (NHAI) and the Rural Electrification Corporation Limited (REC). These AAA rated bonds are backed by the government and hence the capital payout and interest risk is safe.

Here are the key details of 54EC bonds:

Issuer: The 54EC bonds are issued by the National Highways Authority of India (NHAI) and Rural Electrification Corporation (REC).

Objective: The primary purpose of these bonds is to provide a tax-saving avenue for individuals or HUFs who have earned capital gains from the sale of specified assets and want to save on capital gains tax.

Eligible Investors: Any individual or Hindu Undivided Family (HUF) can invest in these bonds to avail the benefit of capital gains tax exemption.

Tax Benefit: Investments in 54EC bonds are eligible for tax benefits under Section 54EC of the Income Tax Act, 1961. By investing the capital gains amount in these bonds within six months from the date of transfer of the asset, investors can save on capital gains tax.

Maturity Period: The maturity period for 54EC bonds is typically 5 years. The bonds are non-redeemable before the maturity period.

Interest Rate: The interest rate on these bonds is fixed and is declared at the time of issuance. It is usually lower compared to other fixed-income instruments.

Maximum Investment Limit: The maximum limit for investment in these bonds is ₹50 lakhs in a financial year. This is per individual or HUF.

Mode of Investment: The investment in 54EC bonds can be made through physical certificates or in dematerialized (demat) form.

Liquidity and Transferability: 54EC bonds are non-transferable and non-negotiable instruments. They are not listed on any stock exchange, and liquidity options during the lock-in period are limited.

Tax on Interest: The interest earned on these bonds is taxable as per the income tax laws applicable at the time.